How to Choose the Right Insurance for Your Business

Running a business means juggling a million things—clients, cash flow, compliance—and somewhere in the back of your mind, you know you need insurance. But what kind? How much? And how do you avoid paying through the nose? Here’s your quick roadmap to figuring out exactly which policies you need, why, and how GMAC Works can shop the market to lock in the best premiums for your unique risks.

How to Choose the Right Insurance for Your Business

(and Score the Best Rates with GMAC Works)

1. Start with a Risk Assessment

Before you buy a single policy, get crystal-clear on what could go wrong:

Property Damage: Do you own a storefront, warehouse, or valuable equipment?

Third-Party Injuries: Are customers or vendors visiting your premises?

Professional Advice: Do you provide any kind of consultancy, design, or technical plans?

Employee Injuries: Do you have W-2 staff or regular subcontractors?

Auto Exposure: Do you use vehicles for deliveries, service calls, or hauling materials?

Cyber Threats: Do you store customer data or rely on cloud systems?

Pro Tip (Opinion): If your gut tells you “something bad could happen here,” assume it will—and insure accordingly.

2. The Core Policies Every Employer Needs

General Liability Insurance

Covers third-party bodily injury and property damage (e.g., a client slips in your lobby). A must for any walk-in business.

Commercial Property Insurance

Protects your buildings, equipment, and inventory against fire, theft, vandalism—and yes, windstorms.

Note (Fact): Claims for property damage cost small businesses an average of $120,000 per incident (NAIC.org).

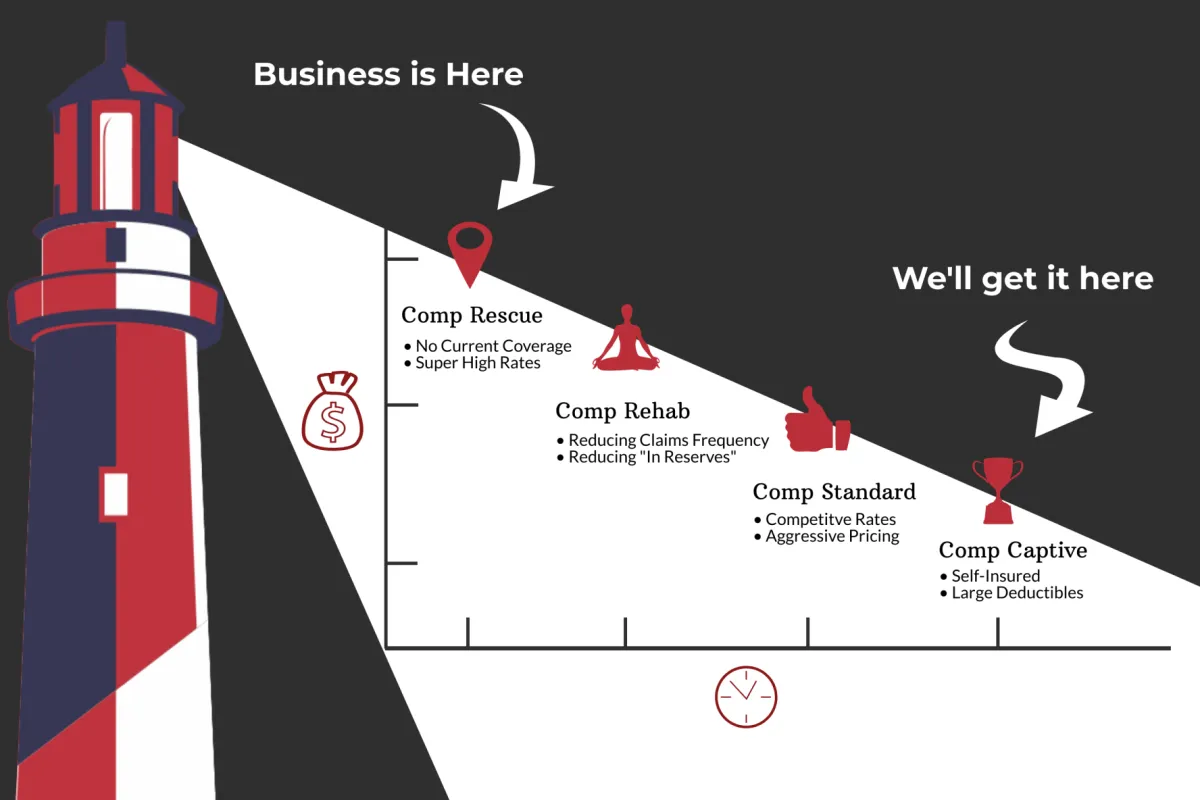

Workers’ Compensation

Covers medical bills and lost wages if an employee gets hurt on the job—and in most states, it also shields you from lawsuits.

State Requirements: New York, Nevada, and Utah require it even for sole proprietors; Texas doesn’t mandate it at all

Commercial Auto Insurance

If you—or your team—use vehicles for any business purpose beyond commuting, you need a commercial policy.

Professional Liability (E&O) Insurance

Protects against claims of negligence or errors in professional services—from architects to accountants.

Cyber Liability Insurance

Small businesses account for nearly half of all data breaches —this policy helps you recover from hacks, ransomware, and privacy-breach notifications.

3. Specialty Coverages (Pick and Choose)

Depending on your industry, consider adding:

Inland Marine Insurance for tools and equipment in transit

Business Interruption Insurance to cover lost income during forced closures

Employment Practices Liability for claims like wrongful termination or harassment

Environmental Liability if you handle hazardous materials

4. How GMAC Works Gets You the Best Rates

Broad Market Access

We partner with 50+ A-rated carriers, so we can compare apples to apples—and find the insurer that best fits your risk profile.

Customized Bundles

By bundling General Liability, Property, and Commercial Auto, you’ll often qualify for multi-policy discounts of up to 20%.

Risk Management Consulting

Our in-house safety experts will audit your operations and recommend simple fixes—like updated ladder-use protocols or cybersecurity training—that can earn you lower experience modifiers and premium credits.

Fast, Transparent Quotes

No bait-and-switch: You’ll see each carrier’s rates, coverages, and exclusions side by side in our online portal.

Proactive Renewal Reviews

As your business grows (or your driving record stays spotless), we’ll renegotiate your rates and coverage levels—so you never overpay year after year.

5. Next Steps: Get a Free, No-Obligation Quote

Ready to lock in coverage that fits your budget and risk profile? Our team at GMAC Works specializes in helping contractors, logistics firms, roofers, and small-biz owners find tailored insurance solutions—fast.